Looking for a Bay Area Mortgage Pre Approval? The home loan process in the Bay Area can be full of challenges and “turbulence” sometimes. Rest assured the challenges are 100% worth it in order to become a home owner.

If you want to cut to the chase and get your pre approval just go here.

Processing a home loan is a lot like landing an airplane….

How so you ask…? No matter how good your pilot is… They may run into unforeseen turbulence. You must count on careful planning and experience for your pilot to land the plane safely, on time and at your destination.

There is a lot that CAN go wrong during an escrow process below I’ve included the most common types of “TURBULENCE” you might expect during the home loan and home buying process.

People ask me all the time about the loan process how it works and how long it takes…

There is no way to tell for sure and every transaction is different to be sure…

People also read – Why should I get Pre Approved first

Ignore these rules at your own peril.

-

Don’t buy a new car or trade-up to a bigger lease

-

Don’t quit your job to change industries or start a new company

-

Don’t switch from a salaried job to a heavily-commissioned job

-

Don’t transfer large sums of money between bank accounts

-

Don’t forget to pay your bills — even the ones in dispute

-

Don’t open new credit cards — even if you’re getting 20% off

-

Don’t accept a cash gift without filing the proper “gift” paperwork

-

Don’t make random, undocumented deposits into your bank account

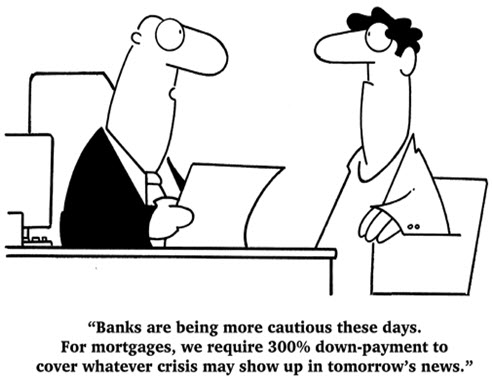

Most people that own real estate obviously don’t go through the mortgage process on a regular basis, and are not aware of how much more difficult the process is compared to a few years ago. If you got a home loan or a conventional mortgage in the 90s or early 2000s you probably remember very little documentation and a thin credit file. Now a days the process can seem about at tedious and difficult as a commercial flight through a hurricane.

There are a ton of New Rules to learn about!

HOW IS PROCESSING A LOAN LIKE A CROSS COUNTRY FLIGHT?

Speaking of a Commercial Airline Flight it may be the best way I can prepare you for what may lie ahead…

Financing a home could often be like taking an airplane flight across country.

When you start on your trip you have no idea how the trip will go, not matter how much you plan.

Neither does the pilot!

You could run into many different types of turbulence. As a passenger on a plane there is not much you can do when you hit turbulence accept put your seat belt on and trust in the training and expertise in the pilot.

Certainly the pilot will try to use his or her experience to navigate around the storms and go for the smoothest flight plan, but if they’re honest, they can’t promise a turbulent-free trip. However the pilot can never promise that weather issues and unforeseen issues with the aircraft won’t delay your flight or ground you somewhere where your plans get foiled.

Their job is to simply get you to your destination in the least time and with the least aggravation, while keeping you as informed and as safe as possible throughout the trip.

Who Does What in the Mortgage Process?

- Loan Originator – Your loan consultant is like your pilot. It is our job to guide you through the process while doing our best to arrive on time and avoid turbulence. They should keep you informed and return phone calls emails and answer your questions in a prompt and timely manner. Depending on the lending relationships he has, your Loan Consultant can find you the best loan with the best pricing for your unique situation. There are many aspects of the loan process that your Consultant does not have direct control over and cannot influence. However a good Consultant will get you the loan you need and won’t bail out during mid flight. Be aware that there have been many new regulations and Mortgage Brokers are now required to acquire special education in order best benefit the consumer.

You can check your Brokers DRE License and their status with the NMLS to be sure that they are one of the best professionals around.

Don’t be afraid to ask your Loan Consultant for their License numbers. They should be more than willing to share if they are a good Loan Agent.

Be aware that if you work with a retail bank it is highly likely that the person processing your loan has not achieved ANY of the requirements that a Mortgage Loan Originator or a Broker must maintain.

- Lender Underwriters – The lender can be like the weather… We can plan and use our experience and expertise however you never know when a thunder storm can pop up and cause turbulence. Since the mortgage crash in 2005 underwriters are required to adhere to strict guidelines governed by Fannie Mae and Freddie Mac. Often navigating through tough weather you MUST take more time and deal with delays in order to arrive safely at your destination.

- Clients Borrowers – Are like that passengers in the plane for the Mortgage Process. It is important that you listen to your Consultant and be prompt when they ask something of you in order to close your loan, however you really must relax and trust that your Consultant wants to land your plane or close your loan as efficiently as possible.

What are the Main Steps of Processing a Mortgage?

- Initial Consultation – Spend time speaking with your Loan Consultant, be honest and up front since your Loan Agent wants to get you the loan as badly as you want it. During this time your Loan Agent should educate you on loan programs that you qualify for along with closing costs, interest rates and the benefits or working with different lenders on your loan.

- Information and Documentation Gathering – In this day and age there is a lot of documentation that goes along with processing a mortgage. Gather ALL the documents your Loan Agent asks for in order to process the loan most efficiently at the beginning of the transaction.

- Pre-Underwriting and Submission – Your Agent will evaluate your files, including income, credit, work history and assets in order to make sure that the lender you are working with will have the best chance of approving and funding your loan. Once the file is ready and you have a purchase contract your Agent will submit the entire loan package into the lender that best fits your situation.

- Lender Underwriting – Once you’ve been pre approved, you’ve found a property and gotten it under contract… It’s time for underwriting. Depending on the lender and how much business they do underwriting can take a day or two from the submission time. Once the lender approves the file they will ask for any “Conditions” or additional items needed to get clear to close your loan. Often it can be frustrating and time consuming as many times you will have to go back and forth with underwriting on several occasions depending on the loan file.

- Clearing Lender Conditions – After an initial underwrite the lender will have questions and concerns that we will need to address with documentation. Every loan approval is different and every loan approval comes with a conditions list that must be cleared. Depending on how complex the file is it is not uncommon that you may need to go back and forth with the underwriter once or twice.

- Cleared to Close – Once the underwriters are satisfied with your loan file and all Fannie Mae guidelines have been met. The lender will issue a clear to close and allow your agent to order loan documents for signing.

- Funding Dispersed – After the loan documents have been signed and notarized by all parties the lender will review the package and make sure everything is complete. This process often takes 48 hours or more. Sometimes there may additional items the lender will require before actually funding your loan. Once everything has been met the lender will send the funding wire to escrow where the funds will be dispersed to all parties involved. Just like coming in for a landing this can often be the most stressful part of the loan process… You must trust your pilot to land you plane and be patient.

- Recording Of Documents – The next day escrow will close and your documents will be recorded with the County you live in! Congratulations you’ve finally landed!

PEOPLE ALSO READ –> Most Common Errors to Get Your Mortgage Application Denied Last Minute

IT’S ALL WORTH IT WHEN WE ARE FINISHED HAPPY DAY!

As your Loan Consultant, I see myself as the pilot of your plane. My job is to assist you in getting your home financed with the best service, in the least time, with the least aggravation. While we may hit some turbulence along the way, I will try to utilize my experience and expertise to take you on the smoothest flight that I can.

I will not bail out on you and I will continue to be your teammate throughout the final leg of your trip until we get safely to your destination.

Rest assured, your advocacy is my number one goal, and that means you must be delighted with the service I provide and deliver that hopefully goes beyond your expectations.

I will keep you posted as we move through the process. In the meantime, please call or email me with any questions I would love to speak with you!

Or leave me a Comment Below Let me know your thoughts or your personal experience with your last Mortgage Loan. If you found this article helpful PLEASE share this on Facebook and your Social Networks!

How to best communicate on properties you like

- Login to your account here

- Download our MoveTo App if you are using an iPhone (this app is updated more frequently than Zillow and other popular consumer sites)

- Save any relevant searches you like? (I’ll save one for you based on what we’ve been looking at) Properties with Red Arrows were recently reduced and the seller may be very motivated.

- You will be notified when new homes come up or if there are any price reductions on homes you’ve been looking at.

- On the site or in the app if you click “favorite” or “request showing” I will get notified automatically and put together comp reports and showing schedules for you.

This way we can be kept in the loop together on what you like and are interested in with just one click without you having to email or call every time.

Check out these case studies of fast home closings.

Until Next time Here is to your success! Jason Wheeler

GET YOUR LOAN APPROVED FAST HERE

When your application is approved, you receive a good faith estimate. The estimate summarizes all of the settlement charges plus your monthly payments. Information related to your property taxes and homeowner insurance will be included if those charges are to be paid out of an escrow account held by the lender.

It is absolutely simpler over a lot of men and women believe.

While you are waiting for the launch of these tablets, you can consider

some of the other tablets available in the market. The actual pc is usually Wi-Fi enabled and can connect to web

anywhere.