Take a quick look over my shoulder as I compare two very popular low down payment scenarios apples to apples with a zero down payment loan program that most lenders won’t even tell you about.

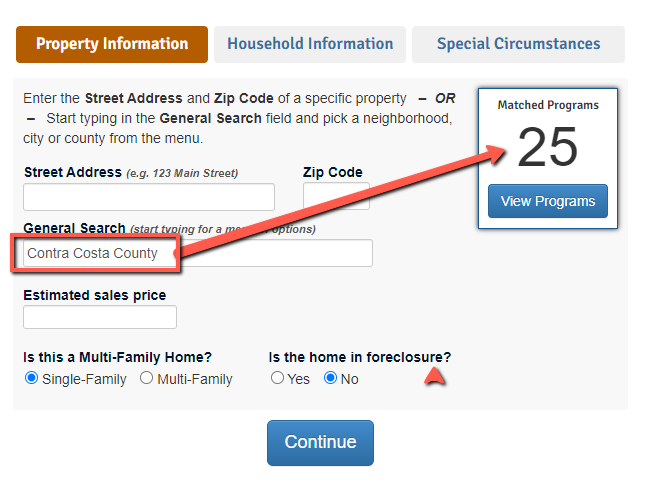

Right now there are several Down Payment Assistance Programs available in Contra Costa County.

Currently there is a program in place for first time home buyers in Contra Costa County that allows for up to 100% financing on a primary home purchase specifically for Contra Costa County that will also cover any of your closings costs.

There are over 2000 down payment assistance programs availably nationwide.

Check down payment assistance in Contra Costa Here

Here are the details for first time home buyers wishing to apply for the first time home buyer grant from Contra Costa County.

You do not have to make payments on this grant.

This program was created to assist low-income and moderate income home-buyers in purchasing homes by providing funds for down payment and closing costs carried out in conjunction with the assisted home purchase up to 105% of the homes appraised value.

This program can also specifically assist, but is not necessarily limited to Teachers, Nurses, Firefighters, Policemen and Veterans right here in Contra Costa County.

What type of assistance is available?

NSP will provide down payment and closing costs assistance to eligible applicants in the form of a silent second shared appreciation mortgage. The interest rate will be based on the ratio of the County loan to the purchase price of the home.

HAVE A QUESTION? ASK US HERE NOW

For example, if your home costs $350,000 and you receive $35,000 in assistance from NSP, your contingent interest rate will be ten percent of the appreciation. You do not have to make regular payments on the loan.

The loan will be due and payable when you go to sell your home. At that time, you would pay back the principal ($35,000) plus ten percent of any appreciation that has accrued

What is the maximum loan amount?

We can help with purchases in Contra Costa county up to $705,000

What is the maximum purchase price?

The maximum purchase price is $705,000

Who is eligible?

If you make under $192,000 household yearly income and have at least a 640 FICO score with a 2 year employment history you should apply for our 100% financing program.

Also… Low- and middle-income households are eligible for the program. A low-income household has a maximum income of 50 percent of area median income, adjusted for household size (e.g. $45,150 for a household of four) and a moderate-income household has a maximum income of 120 percent of area median income, adjusted for household size (e.g., $108,350 for a household of four).

All applicants accepted into the program must attend an approved first-time home buyer course.

MANAGE YOUR DEBTS WITH THIS DEBT REDUCTION CRASH COURSE

In what parts of the County can the funds be used?

The funds can be used in the following High and Medium Priority areas designated by the County Board of Supervisors: HIGH Areas—Bay Point, Oakley, North Richmond, Rodeo, San Pablo, Montalvin Manor/Tara Hills/ Bayview and Rollingwood; and MEDIUM Areas—City of Brentwood and the western areas of Pinole only (Nob Hill, Pinole Shores and Pinon).

Can I use this program with other first-time homebuyer programs?

NSP funds can be used with other first-time homebuyer programs. Make sure that the administrator of your other program knows that you are interested in NSP funds; there are certain restrictions that apply.

Do I need a down payment?

This program requires a three percent buyer’s contribution to be used towards downpayment and closing costs. The buyer’s contribution must consist of your own assets, grants, or gifts. If an individual is buying directly from a bank, the price must be 1 percent less than the market value based on the appraisal.

Do I need to have a house picked out and a purchase contract to use this program?

No, you do not need to have entered into an agreement to buy a house. Your NSP allocation will be reserved for 45 days. If you do not purchase a home within the 45 day time period, you will lose the allocation.

What if I want to refinance my first mortgage at a later date?

Refinancing of the first mortgage is permitted – if you choose to refinance solely for a lower interest rate, the NSP loan will be subordinated. If you refinance for a larger first mortgage amount, the NSP loan will need to be repaid.

How do I apply?

To apply for funds fill out this quick form and we will be in touch with your options.

Or do it the old fashion way and just call us at 925-285-2172! We’d love to have an opportunity to help you understand what might be available for you.

We offer this and other 100% financing, down payment assistance home loan real estate purchase programs in Contra Costa County in cities like Pleasant Hill, Walnut Creek, Concord, Martinez, Clayton and surrounding cities.

This program can assist but is not necessarily limited to Teachers, Nurses, Firefighters, Policemen and Veterans.

Leave Me a Quick Comment or Note