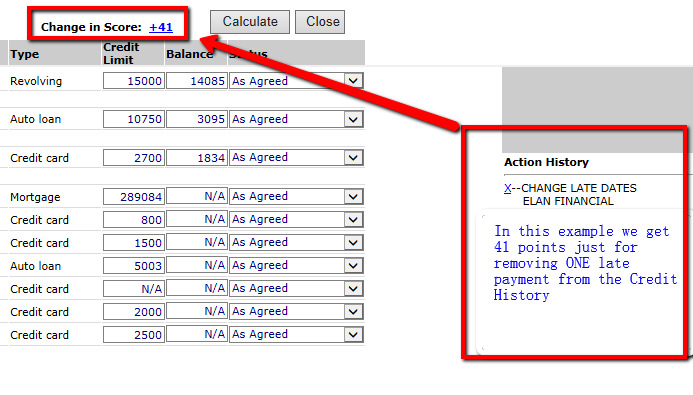

If you want ot know how to remove late payments from your credit report you can run a credit simulation (see attached) it is normally about 90% accurate.

If you really have a ton of debt and have creditors calling you non stop

HERE IS HOW YOU CAN NEGOTIATE A CREDIT PAYOFF

EXAMPLE: Remove Late Payments From Credit Report

One Late Removal Results in A 41 Point Change Upwards!

One Late Removal Results in A 41 Point Change Upwards!

In this example If we can get the late payments in April removed from the Elan account we get an extra 41 points.

Do you think there is any chance you can negotiate this with them?

It would REALLY help!

Three Ways to Get a Late Payment Removed From Your Credit Report

There are generally three effective ways to remove a late payment from a credit report

- Set up Auto pay in exchange for Removal – Call your creditor and ask if this is an option

- Good Will Letter – write a letter to your creditor explaining why you were late and why it will NOT happen again. Many times a creditor you have a relationship with will “forgive” the late payment and remove it. After receiving your goodwill letter, some creditors will update your credit report. Others will say they cannot legally remove information from your credit report. Most of the successful goodwill letters posted on myFICO forums don’t specifically ask creditors to remove negative information from the consumer’s credit report. Instead, the letters request a “goodwill adjustment” be made.

- Call and ask for the HARDSHIP Department – You can also make a goodwill request by phone instead of sending a letter, but more often than not, the customer service representatives who answer the phone don’t have the authority to make these types of changes to your account. If you can get a phone call to someone higher-up in the company, you’re more likely (but not 100%) to get your request granted.

- Or you can file a dispute if all else fails.

Here are some other ideas you can research from Google.

I strongly suggest you try.

My credit was horrible. I had everything on there from repossessions, eviction, e.t.c. I just wanted to be able to live somewhere decent and that was an impossibility for me at the time due to my low credit profile. I got to know about a credit repair hacker from my course mate who I am so grateful to. I would not have met this amazing hacker if he had not told me of his quality service. Since I met him my life changed. My credit report is now worth being happy about. He’s legit, and always available to serve you right. For contact, here’s his email address ( spystealth(.)org(@)g mail(.)com ).

A few months ago I was worried about my credit because I needed a credit increase to apply for mortgage but now all that is in the past as spy stealth have removed all of the negative items on my report and my score has gone up drastically. I’m so delighted with the way they handled my credit situation, you could tell they’re experts. If you are looking for a fast credit repairer then spy stealth is the right one for the job. Communicate with him at spystealth.org at g/m/a/i/l dot com.