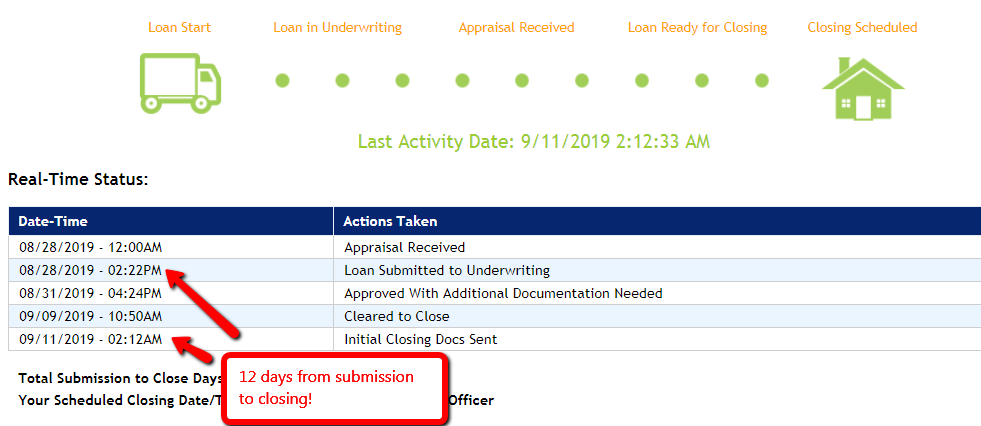

2019 HOME LOAN PURCHASE CLOSED IN JUST 12 DAYS

In this most recent case study we closed this purchase loan in just 12 days!!

The loan was submitted on August 28th 2019 and we had closing docs ready on 9/11/2019

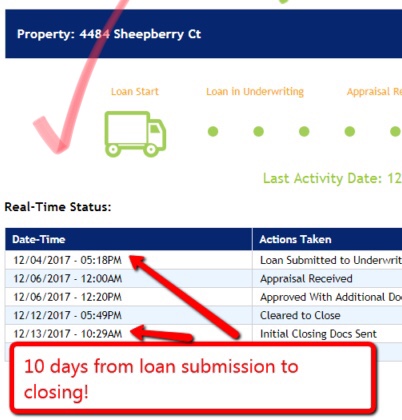

We closed this purchase loan in only 10 days!

In this recent case study I will show you some details and results on our fast-paced purchase promise. If you are looking to close fast on your home purchase… we have plenty of examples for you to review.

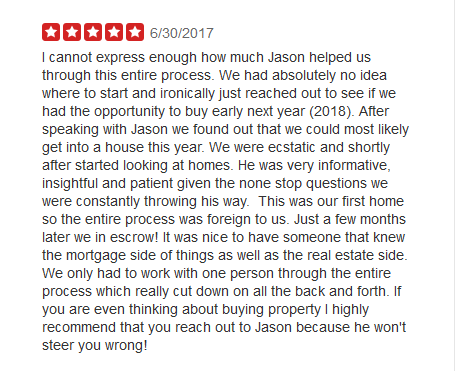

Recently this amazing couple found me initially when searching for information on Google asking “Is now is a good time to buy a home in the Bay Area?”

They stumbled upon my answer on the popular site Quora and quickly called to interview me.

–> Is now a good time to buy in the Bay Area?

Once we got to know each other and we made the decision to work together… We quickly identified a property they wanted to make an offer on and…

25 days later we had secured a contract, closed their loan and given them the keys to their brand new home, just in time to get moved in and set up for Christmas.

The icing on the cake was that they secured the purchase for 10% UNDER the asking price.

This couple was very smart.

They took advantage of our “Fast Paced Purchase Promise”

Here is how our “Fast Paced Purchase Promise” works

-

We will close your new purchase loan between 10 and 14 days

-

You can write your offer with NO appraisal contingencies

-

You won’t find a lower APR on the market than what we can offer you (We challenge you to find a better price on a loan anytime)

In order to get these promises from us you must…

-

Have your file completely pre approved (usually we pre approve files within a few hours)

-

You must provide any required signatures or documents within 24 hours of them being requested once we are in process.

HOW CAN WE MAKE THIS GUARANTEE?

You must call us to see if you are a good candidate for our fast paced purchase promise.

Not ALL loans can be approved or guaranteed to qualify for our fast paced promise.

This offer is unprecedented and you will not find this anywhere else in the real estate industry.

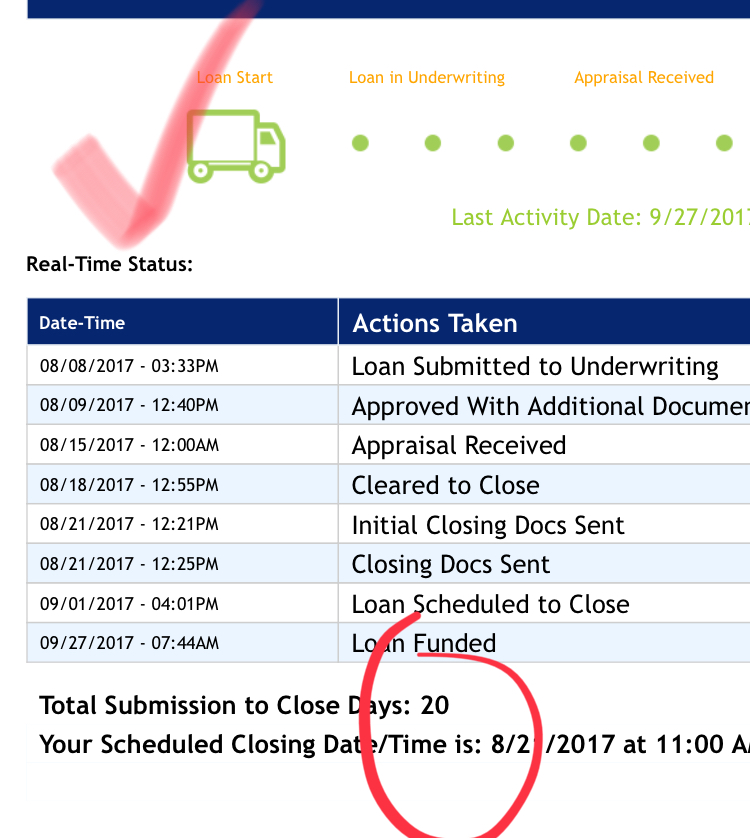

Here is the timeline for this case study of a 10 day mortgage closing

With this loan we were cleared for closing and fully approved within 10 days of loan submission.

That is one fast closing!

HERE ARE THE DIFFERENT TYPES OF LOANS WE CAN OFFER

Our fast-paced purchase promise cannot be guaranteed to everyone.

You must get approved up front to see if you are a good candidate.

If you’d like to learn the details terms and conditions in order to secure this type of transaction you must reach out to us for a 10 minute consultation.

Here is what a recent client said about our Fast Paced Purchase Promise

Here Are a Few More Examples of Fast Closings

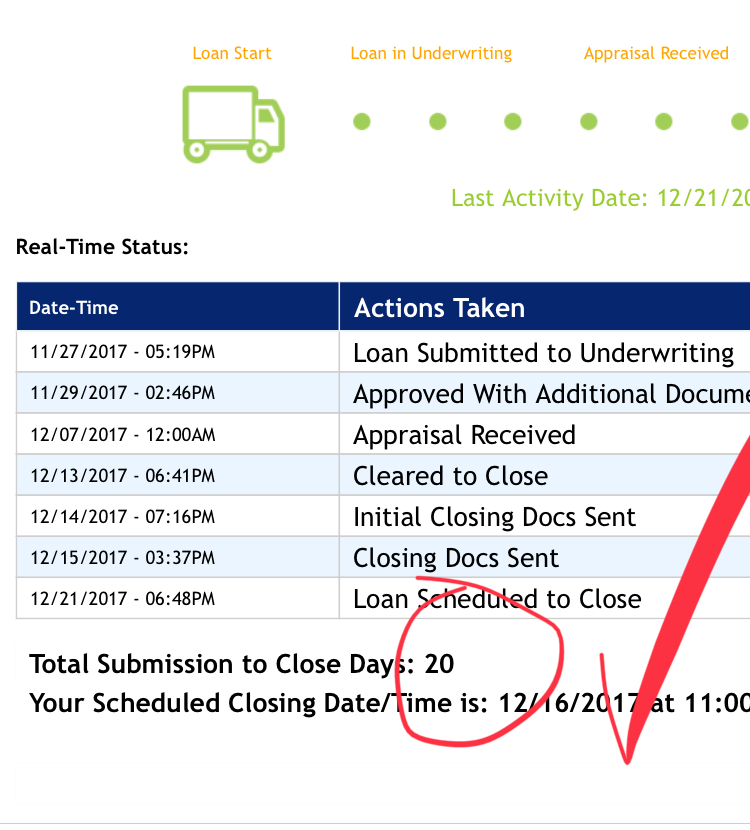

This was a refinance loan where a previous client of mine who had purchased a home a few years ago wanted to…

Lower their rate

Remove mortgage insurance payments

…and take some cashout to pay off some credit cards they had used to fix the home up.

This refinance closed up in just 20 days.

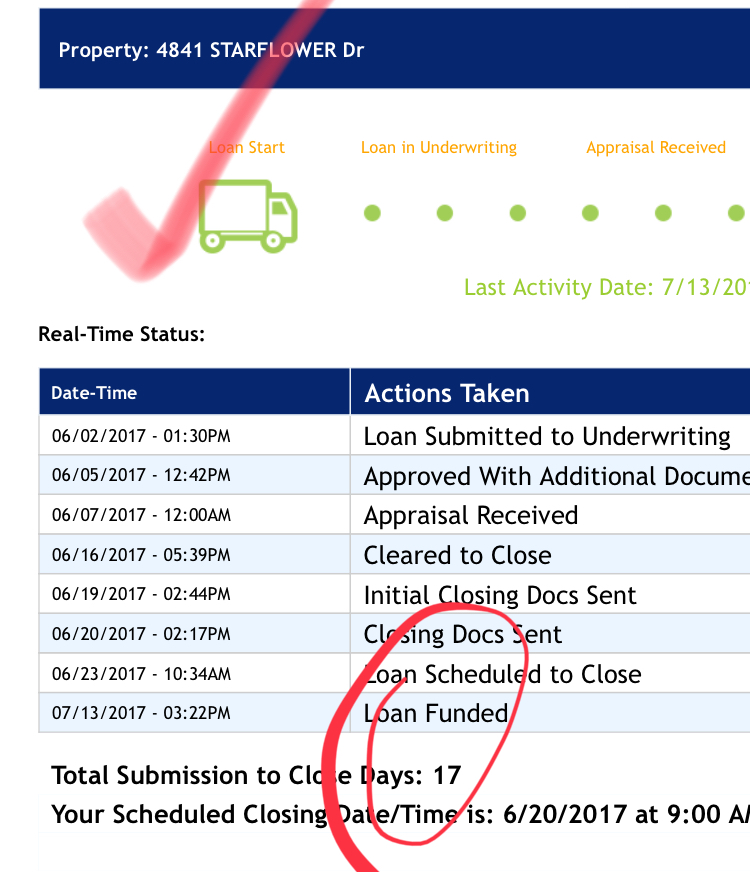

Fast Home Purchase Closing in Pleasant Hill California

This purchase closed in September of 2017 in Pleasant Hill, and we went from contract to closing in just 20 days.

These kind of quick mortgage closings are normal for our team to facilitate for the right clients that are property pre approved and pre screened.

Fast Mortgage Purchase Closing in Martinez

This amazing couple was happy to have thier loan close so quickly since the competition in the summer of 2017 was very difficult to overcome for first time home buyers. Since there were so many other buyers bidding against each other, one of the reasons we were able to secure this contract is that we…

Were able to make an offer with NO APPRAISAL contingency… (Talk to me about this)

Were able to promise the seller a very fast closing under 21 days.

Is this Program Right for YOU? Again… Here’s how it works.

We review and pre-approve your file. Usually this can be done within just a few hours from receiving your financial information.

Once we pre-approve your file and recognize you are a good candidate for our fast-paced purchase promise we will offer you the absolute lowest rate and overall APR on a loan with lowest closing costs. (excluding taxes and insurance that you must carry as part of home ownership)

Your offer can be written with no appraisal contingency if you are needing to make your offer competitive.

–>Related: How Recent Government Policies are Changing Bay Area Market

Do you want to see if our 10 day closing is for you?

For more details on exactly how this works reach out to me personally on my cell phone… We primarily offer this program in the East Bay Area and specialize in helping home buyers in Pleasant Hill, Concord, Walnut Creek, Martinez and Lafayette.

So… We’ve showed you our case study.

We’ve showed you the lending timeline.

We’ve explained exactly what you need to do.

NOW it’s time for you to take action and find out if this could work for you.

Call me here at 925-285-2172

Search Newest Contra Costa Home below

–> Here is what our clients are saying

Maybe you have NO IDEA how to get started and you’re afraid to talk to a professional…

NO PROBLEM! My mission is to bring you VALUE, answer your questions, and most of all make sure you are comfortable.

Get started with our 20 minute crash course where we answer the most common questions

Leave Me a Quick Comment or Note