THIS PROGRAM IS TEMPORARILY DISCONTINUED FOR NEW CLIENTS

Are you a real estate investor in the Contra Costa Bay Area? Have you found a great wholesale property however lack the funds to close such a deal?

We specialize in transactional short term funding to help you close more Wholesale real estate deals. Short term financing is not based on your credit or employment history. A lot of our business comes from Traditional Mortgages and Commercial Financing however with this niche product we can help you finance your back to back closings and wholesale real estate deals.

Call or Email Us now for a Quick Approval and Personalized Quote 925-285-2172

——————————————————————-

|

|

YES! Quick, Easy Approvals | NO Credit Checks | |

|

|

YES! Funds 100% of the A-to-B transaction! | NO Upfront Fees | |

|

|

YES! Funds Your Closing Costs | NO Loan to Values | |

|

|

YES! Easy On-line Funding Request | NO Appraisal Expense | |

|

|

YES! Funding in any State | NO Income Verification | |

|

|

YES! Fair, Competitive Fees | NO Personal Docs | |

|

|

YES! Our Title Company or Yours | NO Hassles |

—————————————————-

Transactional Funding for Real Estate Investors: How Does it Work and What are The Costs and Fees to Fund a Deal?

HERE IS A DETAILED CHECKLIST ON WHAT YOU NEED TO GET TRANSACTIONAL FUNDING

DOWNLOAD TRANSACTIONAL FUNDING DETAILS AND FAQS HERE

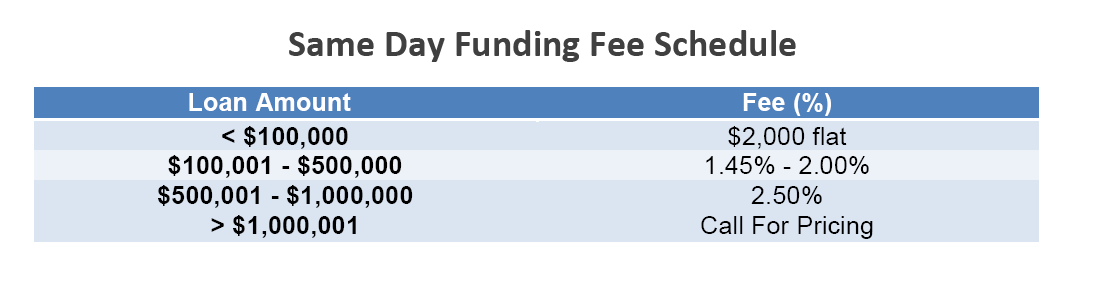

- We can finance your real estate project for as little as 2.5%

- Funds available for back to back closings

- Income and credit are not a factor in qualifying.

- Private funds that are not controled by Fannie Mae or Freddie Mac.

- Up to 100% LTV on your make sense real estate transaction

- Qualifying is easy and we don’t check your credit or income

————————————————————————————–

How Does Transactional Funding Work?

A true back-to-back closing is often referred to as “A to B, B to C” in the real estate investing world. Essentially what is happening is, a homeowner (the A party) goes into contract with an investor (the B party) so the investor can purchase their home. During the time frame the investor has between the contracted date and the actual closing, the investor (B) works to find an end buyer (C) who will purchase the home from the investor the same day they buy it, or as quickly as the deed can get recorded, at a higher price.

When you are doing back-to-back closings it is essential that each transaction stands on its own, independently. In order to create this independence, you, the investor, are required to provide their own funds (we call this “wet” funds) to consummate the purchase from the seller before you can resell to the end buyer. You, the investor are required to do this because you are not allowed to use your end buyer’s money to fund your purchase.

For Example:

SELLER(A) sells $200,000 home to INVESTOR(B)

WE PROVIDE YOU THIS $200,000 TO CLOSE YOUR DEAL

Then as quickly as possible

INVESTOR (B) resells home for $230,000 to END BUYER (C) For a Profit

How Does Transactional Funding Create An Opportunity For You, The Real Estate Investor?

Most investors are limited by their capacity to fund deals. In other words, when the money stops, the deals stop. We have created this funding system so you can totally eradicate that concern form your business. Access to our money gives you the ability to close more deals, make more money, and help more distressed homeowners. It is true “NO MONEY DOWN REAL ESTATE” in today’s market. Opportunity abounds.