UPDATE: yup they finally did it… the FED raised rates.

The Federal Reserve did it — raised the target federal funds rate a quarter point, its first boost in nearly a decade.

That does not, however, mean that the average rate on the 30-year fixed mortgage will be a quarter point higher when we all wake up on Thursday. That’s not how mortgage rates work.

Mortgage rates follow the yields on mortgage-backed securities. These bonds track the yield on the U.S. 10-year Treasury.

The bond market is still sorting itself out right now, and yields could end up higher or lower by the end of the week.

WHY THE FED HIKE DOES NOT MEAN DOOM

This week brings a long-awaited rates decision from the Federal Reserve as well as a new handful of important economic data.

Meanwhile, lawmakers in Washington, D.C., need to come together on a long-term bill that would avoid another government shutdown, and movie theaters around the world will be transporting Star Wars fans to a galaxy far, far away.

Will it be something feels different this time.

Or is the FED pulling out leg again on raising interest rates?

We are also in the full swing of the holiday season.

That means less buyers are in the market, inventory is lower and sellers are usually more motivated.

HERE ARE THE LOCAL REAL ESTATE DATA FIGURES FOR EAST BAY TOWNS

WILL THE FED RAISE RATES?

Mortgage rates spiked on last week after a bit of drama from the European Central Bank and

comments from Fed Chair Yellen.

Economic news continues to buttress the probability that the Federal Reserve will increase interest rates at its meeting next week.

While some additional economic acceleration would be great to hear, we are still in a very slow recovery.

However, according to many experts, we are now at a point where it makes sense for the Fed to move away from emergency levels of support.

The biggest news of last week was that the unemployment rate remained at 5.0% and another 211,000 new jobs had been created.

Even though the ISM indices each stepped backwards last week, the market appears to have already priced in a Fed rate increase. This week will likely be focused on Retail Sales data.

With some sectors of the economy slowing, a strong showing from consumers, in terms of dollars spent last month, will further increase the odds that we could end 2015 with the first increase from the Federal Reserve in almost ten years

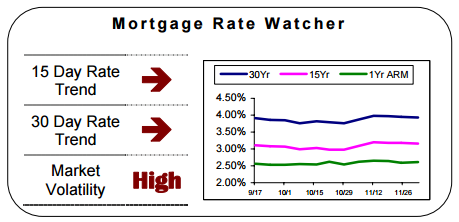

MORTGAGE RATE TREND LAST THREE MONTHS

I’m looking for rates to stay relatively flat and quiet until the FED makes their decision on the FED funds rate increase later in the month.

Float / Lock Recommendation

If I were considering financing/refinancing a home, I would….

Lock if my closing was taking place within 7 days…

Lock if my closing was taking place between 8 and 20 days…

Lock if my closing was taking place between 21 and 60 days…

Float if my closing was taking place over 60 days from now…

This is only my opinion of what I would do if I were financing a home. It is only an opinion and cannot be guaranteed to be in the best interest of all/any other borrowers.

PDF-DECEMBER 2015 MORTGAGE RATE WATCHING

SOMETHING WORTH REMEMBERING

Good old Bob Ross was always painting those happy little trees.

Re framing and Turning life’s screw ups into something positive is not always easy but it will will always keep you headed in the right direction.

Leave Me a Quick Comment or Note